J. Michael Jones

This article was coproduced with Mark Roussin.

The average age of a car in the United States is now 12.2 years. That’s a new record, according to S&P Mobility.

A lot of things changed due to the pandemic. A lot of other things didn’t change so much, only accelerated.

Cars fall into that latter category. Really, the average age has been climbing higher for five straight years now.

Don’t get us wrong. The pandemic did negatively impact supply chains across numerous industries. In the case of cars, we saw and continue to see semiconductor availability issues that forced many manufacturers to slow or even halt production.

That led to prices surging for a solid six months – or more! As a result, consumers were getting huge trade-in values for used vehicles. And many buyers were stuck basically buying what they could get.

Mark even spoke with people who traded in their vehicles for more than what they paid for two years prior.

Buying a Car “Bites” Even More

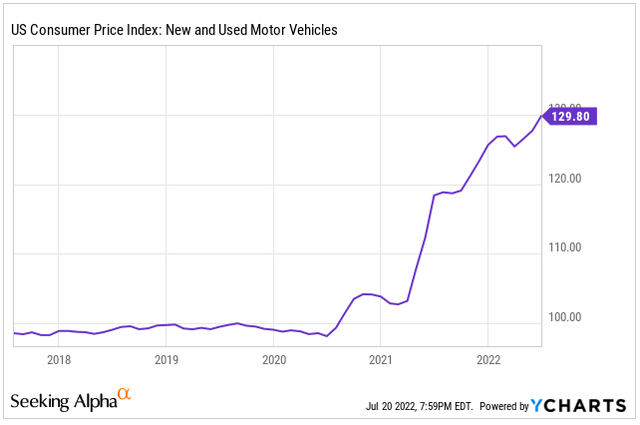

To get a better grasp of what’s going on, check out this next chart. It looks at the U.S. Consumer Price Index for new and used vehicles over the past five years.

Seeking Alpha / YCharts

Now, most of us have long-since considered going to the dealership a battle: one we have to prepare for. The sides are clearly drawn, with the sales people trying to force you into a higher price and you pretending to walk out without a lower price.

Typically though, you could agree to a price below the manufacturer suggested retail price (MSRP).

In 2022 though, that all changed. Negotiations are now a rarity. Worse yet, you’d most likely end up paying a set price along with a “dealer surcharge.”

That amounts to anywhere between $5,000 and $10,000, depending on the dealership. To be clear, that’s on top of MSRP.

It’s either that, or you don’t get a car. Anywhere. And for a while too.

For that matter, even if you grit your teeth and sign on the dotted line… you might have to wait regardless if you’re trying to get something new. Some vehicles are back ordered for months.

So it’s no surprise then how many consumers are keeping their current vehicles. In which case, they’re more reliant on parts and pieces to keeping those vehicles running.

This leads us to the companies that are set to benefit from this situation, auto parts retailers such as:

- AutoZone (AZO)

- Advance Auto Parts (AAP)

- O’Reilly Automotive (ORLY).

Let’s see who wins!

Get in the Zone… AutoZone!

Although the S&P 500 recently crossed back under the 20% threshold for the year… many investors remain hesitant to believe the bottom is in. And we can’t disagree.

We’re definitely not out of the woods when it comes to slowing economic activity. Plus, rates are still set to rise and volatility will no doubt remain high in the near term.

So a cautious or defensive approach is still smart when building out your portfolio. In which case, AutoZone could be a worthwhile addition.

Shares have traditionally performed well even during rougher times. According to FactSet, it has a total average return of 22% over the past three bear markets (i.e., 2000, 2008, and 2020).

AZO has outperformed that of the S&P 500 so far. While that major index is down on the year, AZO is up 7.3%.

And over the past month alone, it’s up roughly 10%.

Similar to other industries, AutoZone is coping with supply chain restraints. But this is also something that’s benefitted it. (Its competitors too, admittedly.)

With service stations and mechanic shops struggling with finding parts – not to mention staff – consumers have an even greater incentive to try doing small repairs or services themselves.

And, of course, an older vehicle usually equates to more maintenance.

AutoZone Continued

At the end of June, Goldman Sachs (GS) upgraded the stock to buy with a price target of $2,296. On the flip side, Bank of America (BAC) believes the demand for do-it-yourself (DIY) auto maintenance will decelerate.

It’s also important to note that the company has higher exposure to lower-income customers.

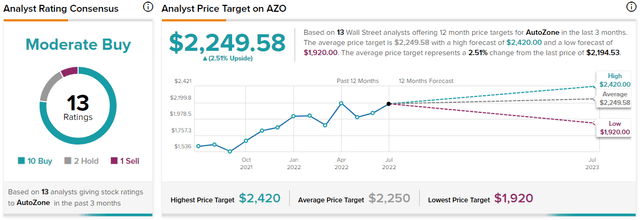

Overall, the general feeling on Wall Street is that AZO shares are fairly valued – or at least they were before yesterday. The 13 analysts following it have an average 12-month price target of $2,250.

TipRanks

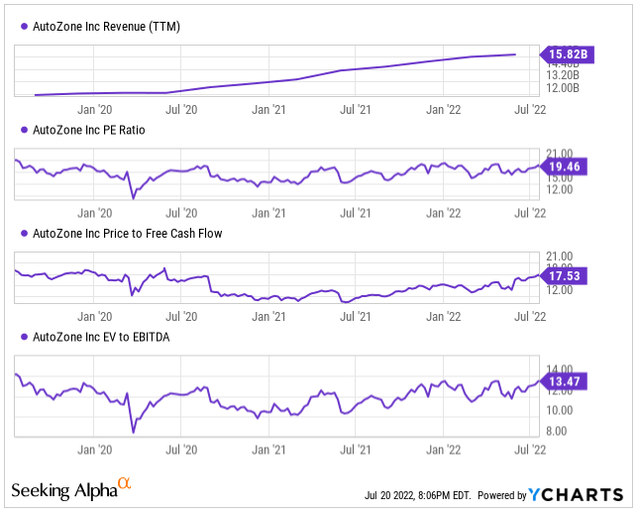

Again going off of Tuesday’s closing price, AZO does appear to be fairly valued… if not slightly overvalued when looking at free cash flow (FCF) and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Check out how the stock is trading in terms of earnings multiple, FCF multiple, and EBITDA multiple… all the while revenue has steadily increased.

Seeking Alpha

If AutoZone can capitalize on the aging vehicle renaissance the U.S. is seeing – and maneuver through the high inflation and high transportation costs – then we don’t see why it can’t continue to perform well.

In addition, it’s maintained a very aggressive stock buyback program… one that’s seen the number of outstanding shares decrease by over 30% in the past five years alone.

Nothing is screaming out Strong Buy to us at Tuesday’s closing price. However, if you’re already a shareholder, then this is likely a quality position to hold.

Advance Auto Parts: There Before You Need It

Up next, Advance Auto Parts is the leading aftermarket parts retailer in North America with nearly 5,000 stores and branches.

Interestingly, unlike AutoZone, the majority of its sales come from professionals rather than DIY customers.

Through the first 16 weeks of the year, AAP saw a slight increase in revenue. However, selling, labor, and transportation costs caused operating margin to fall from 7.5% a year ago to 6% year-to-date.

Margins continue to be an area of concern, but that’s not surprising given raging inflation. Plus, the company has been focusing on margin expansion since it operates its own brands as well as distributing others.

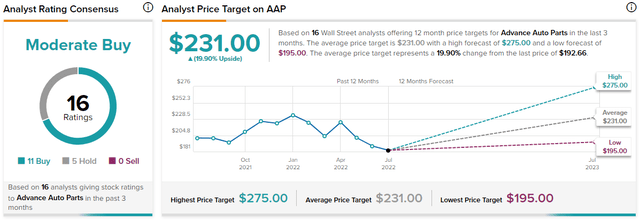

Everything considered, analysts are most bullish on AAP. The 16 who follow it have an average target of $231, which implies nearly 20% upside from Tuesday’s price.

TipRanks

That’s interesting since, year-to-date, shares are down nearly 20%. Though over the past month, they’ve rebounded nearly 15%.

The company plans to open 125-150 new branches this year. And although revenue growth has been slow so far, it’s tough to compare anything to 2021 given the vast amounts of stimulus it saw.

We accept that as a reasonable explanation from management, which reaffirmed its 2022 guidance recently.

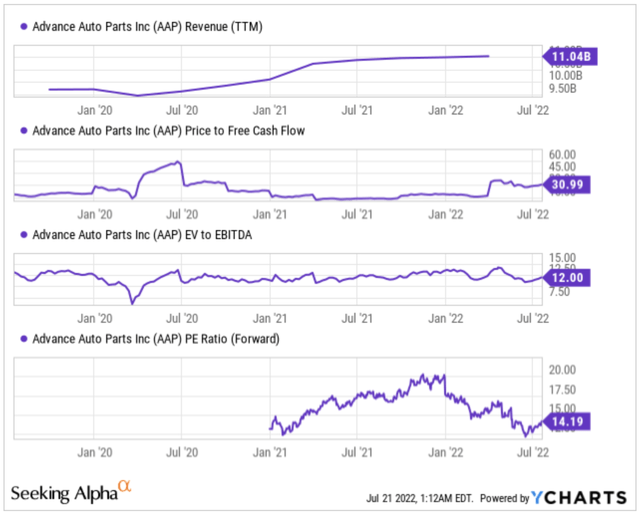

Also, here’s how it’s fared over the past three years.

Seeking Alpha

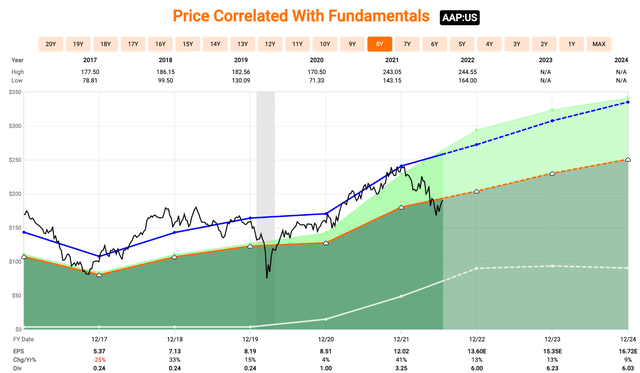

Analysts expect AAP to have adjusted earnings per share (‘EPS’) of $13.60 this year. That equates to a forward P/E ratio of 14.2x.

Looking over the past five years then, AAP has traded closer to 20x… suggesting now may be a great entry point.

FAST Graphs

Other things to know are that the company is looking to buy back $500-$700 million worth of shares this year… and that it pays an annual dividend, which yields 2.62%. It’s been growing at an incredible rate since it was brought to life in July 2020.

O, O, O’Reilly Automotive

Our final auto parts retailer is O, O, O’Reilly Automotive!

Similar to that of AAP, it saw a slight increase in revenue during Q1-22, with comparable-store sales increasing 4.8%. Again, it’s difficult to grow more than that against 2021, where comparable sales grew 24.8%.

Selling, general, and administrative costs weighed on ORLY’s first quarter with those costs increasing 9%. This impacted operating income, which decreased 3%.

One notable item was gross margin, which increased 4% – suggesting some of the inflation costs are at least being passed onto consumers.

ORLY has been aggressive on the share repurchase front. It bought back $775 worth of shares during Q1… which was AAP’s full-year plan.

Here’s one additional thing about all the auto parts retailers. Rolling back Chinese tariffs would impact their businesses, since such items have received sizable tariffs the last four years.

It’s estimated that 30% of the automotive parts come from China, according to UBS.

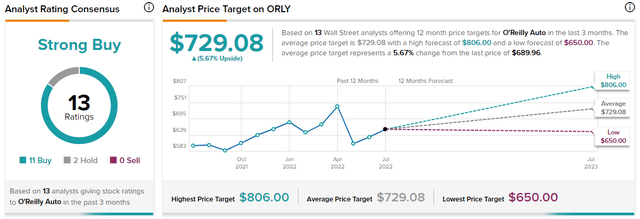

Similar to AZO, analysts appear to like ORLY. However, they don’t see a ton of upside right now.

Out of 13 analysts covering the stock, they have an average 12-month price target of $729. This implies only 5% upside from current levels.

Seeking Alpha

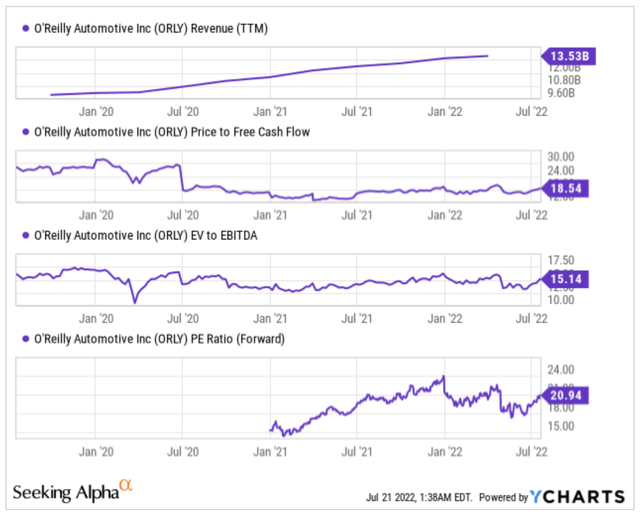

In terms of valuation, revenue continues to climb higher. But from an FCF perspective, shares do look rather interesting.

Seeking Alpha

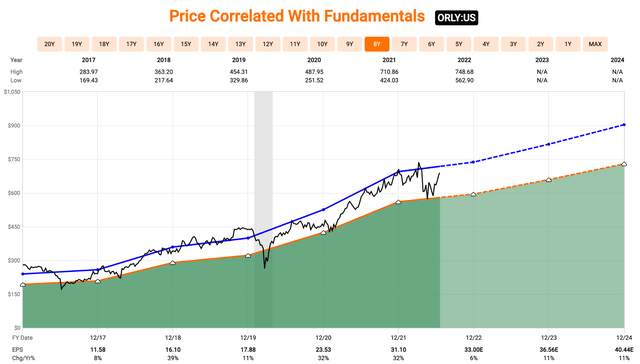

Analysts expect ORLY to earn adjusted EPS of $33 by year’s end, making for a 20.9x forward earnings multiple. Over the past five years, shares have traded closer to 22.3x.

FAST Graphs

On ORLY’s Q1 earnings call, management discussed supply chain issues, expressing a goal to increase in-store inventories by 8% this year.

If you recall, Target (TGT) ran into this issue last year… only to find itself with too much inventory this year. So inventory levels and turnover are something to watch closely in the coming quarters.

Debt to EBITDAR (EBITDA and restructuring and rent costs) levels decreased slightly during the quarter from 1.69x in 2021 to 1.72x this quarter. It continues to make large repurchase investments, which is largely impacting EPS.

In Conclusion…

A few risks are evident when it comes to these auto parts retailers.

- While the U.S. slowdown could be a net beneficiary, inflation costs, wage increases, and transportation costs are not. From an operating income perspective, they exist within a low-margin environment. So this could really hurt their bottom lines.

- The rise in electric vehicles is problematic since they’re practically “driving computers” with 50+ computers on board. Gone are many of the normal aspects of car maintenance. However, Advance Auto Parts did mention EVs in their earnings call, and how it’s preparing to accommodate them.

- Considering how much of their product is made in China, continuing lockdowns will continue to hurt it. On the upside, as more and more U.S. citizens are told to return to the office, the more they’re going to need to maintain their cars. The same goes for rising wanderlust.

All three of these auto parts businesses have BBB credit ratings. So they’re investment-grade with strengthening balance sheets.

Overall, they’re looking to thrive over the next 12 months as the average age of vehicles continues to climb. As long as management can weather the inflationary storm…

And transportation costs…

And wage costs, they should be just fine.

If we were to choose one of them, we’d probably side with AAP. It appears to have the most upside – again, assuming its expansion plans and supply chain changes come to fruition.