Western Europe’s vehicle current market tanked once again in June, with revenue down 17% on past year’s amount at below a million units, according to details released by GlobalData automotive forecasting unit LMC Automotive.

Europe’s car market is coming underneath pressure from two primary sources. To begin with, sales are nevertheless seriously constrained by the shortage of critical sections because of to the world semiconductors disaster. A supply chain crisis that started last 12 months is continue to with us in 2022 and forecast to continue being a factor into 2023, when efforts to elevate chips production capacity really should start out to bear fruit. The phrase in the sector is to count on a gradual easing alternatively than a unexpected resolution to provide challenges.

For now, auto suppliers are having to prioritise increased margin cars to leave factories where by they can, but that nonetheless leaves some model lines running quick and offer to sellers impacted. In addition to this, some suppliers – notably Tesla – have experienced world-wide source traces currently being adversely impacted by ongoing Covid-19 effects, specially in China.

Even though ready lists and order instances are unprecedentedly extensive, brands are in the situation of offering to those people existing schedules when they can. Nonetheless, a expanding issue is fundamental demand and the macroeconomic backdrop in quite a few pieces of the planet. This the next sector aspect coming into enjoy to depress profits even further, specially as we get into the 2nd half of the yr when better price tag inflation bites and financial expansion slows. Europe, in particular, is viewing the erosion of serious household incomes due to a increase in selling price inflation – specially fuelled by spike in energy selling prices this yr. Confidence is remaining further harmed by growing curiosity costs and the spill-over effects from a protracted war in Ukraine.

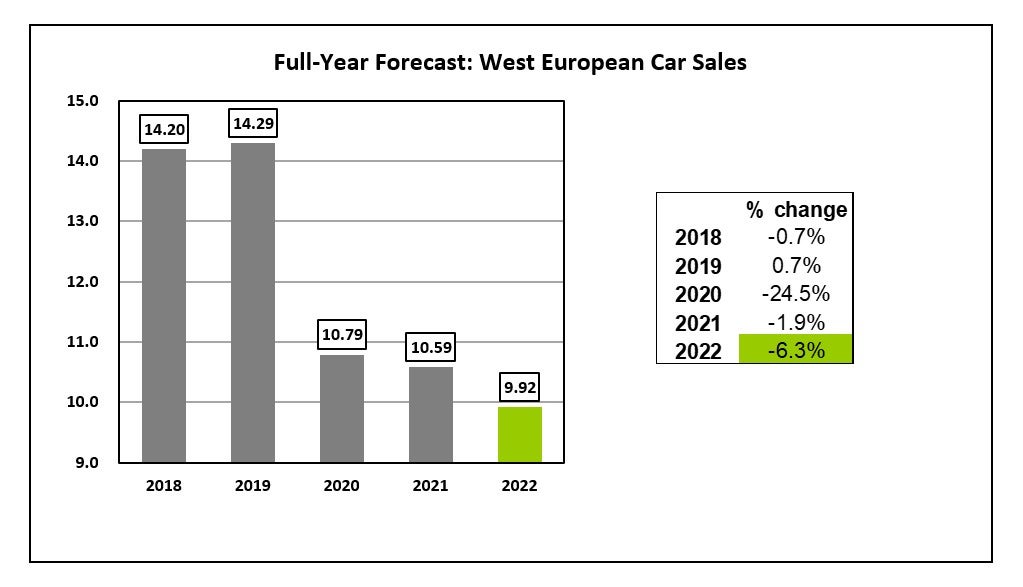

LMC analysts note that when the June registrations consequence for the location was somewhat previously mentioned expectations, it carries on to see the motor vehicle marketplace contracting for the complete calendar year owing to the assumption that the market will not overcome supply constraints at any time shortly. From future calendar year, LMC forecasts a restoration, however new data and the most recent news on ongoing provide issues, sales opportunities LMC to ‘remain careful on the 12 months-on-year improvement’. It suggests an additional concern relates to fundamental demand from customers, which has weakened in latest months as the economic outlook has deteriorated.

Recovery derailed

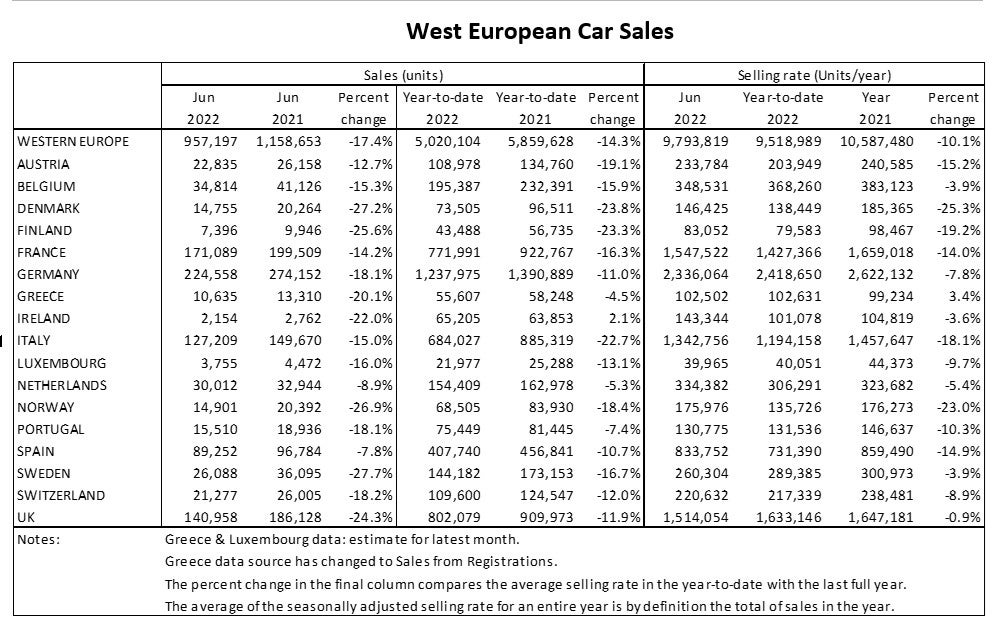

The West European vehicle sector underlying selling fee remained at 9.8 million models a yr in June, bringing the initial half 2022 common to just 8.8 million models a yr. All those annualised selling prices (SAARs) are perfectly below once-a-year outcomes throughout the pandemic scarred many years of 2020 and 2021. A post-pandemic recovery has correctly been derailed by the severe elements offer shortage.

A appear across major marketplaces in the June effects confirms the seriousness of the ongoing source scarcity.

The German vehicle market marketing amount fell modestly to 2.3 million models a calendar year in June, nevertheless uncooked gross sales did boost thirty day period-on-thirty day period (Mother). In the British isles, the marketing level fell to a paltry 1.5 million models a 12 months, marking the worst June for above a 10 years. For France, the offering level remained flat at 1.5 million models a 12 months. Even though in Spain, the promoting fee fell a bit to 834k models a calendar year. The Italian auto sector advertising amount improved on the month just before to 1.3 million units a 12 months, even now properly down below where by it should really be in standard periods.

The hottest quantities will make for sobering reading all-around the market. LMC analyst Jonathon Poskitt instructed Just Vehicle: “The vehicle sector in Europe stays in lousy shape due to supply constraints, with providing premiums below annual final results throughout the pandemic scarred several years of 2020 and 2021. This yr is heading for an yearly drop. While we imagine a restoration from this small amount is in prospect for 2023 as source constraints simplicity, we are careful about its toughness provided the financial headwinds that are setting up this calendar year.”